Trusted Since 2009

Sell Your Maryland Home Quickly for Cash – Reasons Homeowners Choose 3 Step Home Sale

“We buy houses for cash in as little as 7 days!”

Sell My House Fast Maryland. As-Is, No Repairs, No Cleaning Needed

Whether it’s foreclosure, divorce, job loss, or a family emergency, we can offer peace of mind and a fast solution. Sell your MD home in any condition, no need for costly repairs or cleanouts. Avoid dealing with contractors or fixing anything before selling.

Maryland Property Owners Get Cash In Hand Fast. Get a Cash Offer Today

Need to sell quickly due to relocation, downsizing, or an inherited home? No waiting, no showings, no agent commissions, just a fast, simple cash sale.

No Out-of-Pocket Costs. No Hidden Fees, No Closing Costs, Free Sale

You won’t pay anything to sell, no agent commissions, no hidden fees, no surprises.

Homeowners Loved Working With Us, And So Will You!

Sell My House As-Is to a Trusted Cash Homebuyer

Are you dealing with a property that requires extensive repairs? Need an urgent home sale? Whether you need to sell a hoarder house or selling a house with water damage in Maryland, We specialize in purchasing homes that need serious work, ensuring a fast home sale and a smooth transition for you. Forget about costly renovations and lengthy listings. Let us help you sell your house in any condition with ease and confidence, offering fair value and a fast, hassle-free process.

Mold Growth

Mold Growth

Basement Problems

Basement Problems

Outdated Electrical Systems

Outdated Electrical Systems

Unsafe Staircases

Unsafe Staircases

Sewage Issues

Sewage Issues

Unstable Flooring

Unstable Flooring

Damaged Plumbing

Damaged Plumbing

Severe Interior Damage

Severe Interior Damage

Insect Infestations

Insect Infestations

We Buy Your House As-Is. Skip All Repairs

What If I Need to Sell My Maryland House Urgently?

Selling a house urgently in Maryland comes with a lot of moving parts. Between inspections, agent commissions, repairs, and delays from lenders or walkthroughs, the traditional process can slow everything down. That’s why we’ve built a faster, simpler way to sell — without the extra steps or stress.

Sell Your House For Cash MD

Sell Your House For Cash MD

Hi, I’m Josh and this is my sister Elana! Our team here at 3 Step Home Sale has been helping clients sell their house for more than a decade. As an investor who buy houses for cash, we will do our best to provide you a FAST, FAIR and very EASY solution to sell your house for cash. With our state of the art 3 Step process, we buy houses for cash in Maryland. We are one of the fastest all cash legit home buyers near you. Sell fast for cash, skip all the stress and go right to getting paid! MD homeowners, just fill in the form below to get your offer and a fast sale started. Remember, it’s 100% FREE, no Realtor fees, and never any obligation to accept.

We Buy Homes for Cash. No Matter Your Situation, We Can Help!

Providing fast cash offers on distressed homes, rental property with bad tenants, and all sorts of family homes in Maryland over the last 15 years! We’ve encountered sellers in a variety of difficult selling situations and handled them successfully. As experienced cash home buyers in the state, there are very few scenarios we haven’t seen and worked through efficiently with our clients who wants to sell their house fast for cash. No matter your reason for selling we can assist you:

Sell House to Avoid Foreclosure

Sell House to Avoid Foreclosure

Sell An Inherited Property

Sell An Inherited Property

Selling a House For Job Relocation

Selling a House For Job Relocation

Selling a House With a Lien

Selling a House With a Lien

Selling a House That Needs Repairs

Selling a House That Needs Repairs

Sell House and Downsize

Sell House and Downsize

Sell House and Retire

Sell House and Retire

Sell Your House Fast – Skip The Listing!

Sell Your House Fast – Skip The Listing!

The 3 Step Home Sale Buying Process

Selling your house fast for cash to local cash home buyers is quite easy. We remove traditional banks, appraisers and realtors from the transaction. Without any need for approvals from third parties; this makes it Easier, Faster and Less stressful to sell your house for cash to us and get an offer within 30 minutes.

Get Your Free Cash Offer – Fast, fair, and no obligation.

Get Your Free Cash Offer – Fast, fair, and no obligation.

Review and Accept – No pressure. You’re in control.

Review and Accept – No pressure. You’re in control.

Choose Your Closing Date – Choose your closing date. Get cash in hand.

Choose Your Closing Date – Choose your closing date. Get cash in hand.

We Buy Houses for Cash in Maryland — In Any Condition, Any Situation

Cash For Homes in Any Condition

We buy houses in any condition. We give you a no obligation offer that requires no mortgage financing making the selling process simple. We have experience buying all types of houses. We pay cash for your house, make them pretty and sell them! Repairs do not scare us.

Sell Your House in Any situation

Whatever the situation it maybe, we’ve done it all and we’re willing to go the extra mile to make it to the closing table. Whether you need to sell inherited house in Maryland or sell house with liens, we’re here to help. Even if it is behind on taxes or mortgage payments or has code violations, it doesn’t matter. It’s 100% FREE to see what we can offer you and sell your house today!

NO NEED TO CLEAN OR DEAL WITH REPAIRS.

We’re serious when we say “AS-IS”, take what you want and leave the rest.

We Can Buy Your House Fast for Cash – The Better Way, No Agent Needed

We provide cash solutions to homeowners looking to sell their houses fast. Our cash offers are particularly valuable because we rely on our own financial resources, eliminating the need for banks, lenders, or external decision-makers. This means there are no hold-ups due to third parties. When we make a commitment to buy your house, you can have confidence that we will follow through on our promise.

Offer Within 30 Minutes

Offer Within 30 Minutes

On most cases, we only need 30 minutes to conduct our assessment to give you our offer. We’ll even walk you through how we calculated our offer.

No Realtors, No Fees/Commission

No Realtors, No Fees/Commission

We are your direct cash buyer, you will not need to worry about paying for agent commissions and broker fees.

100% Free

100% Free

Yes! That’s right. It’s completely free, No Obligation, No Pressure and No Hidden fees. We even cover your standard closing costs.

No Repairs Needed

No Repairs Needed

Many sellers waste money on repairs that are not done correctly. We buy based on the potential of the house. Skip doing any repairs that may have to be undone and sell to us “as is”.

Experienced Transaction Team

Experienced Transaction Team

Real Estate transactions fall apart without great communication and day to day management. Once you accept our proposal, our team of professionals will assist you through the process, make sure we close on time and get you paid.

Already Got An Offer? Let Us Try To Beat It!

Already Got An Offer? Let Us Try To Beat It!

We really give the highest offers around. We are confident we can beat any valid written offer backed by a legitimate proof of funds, or at least we’ll try.

Cash Offers For Homes in Maryland That Actually Close

Elana with our client at the closing table. This was a very difficult probate situation, everyone was happy to see the finish line!

Deciding whether to sell your house in MD can be tough. You want to make sure that you’re working with the right people who buy houses, who are going to perform and will hold your hand every step of the way from receiving a cash deal, navigating any hurdles in title, and getting you paid!

Do You Need Someone to Buy Your House? We Are Here to Help!

We specialize in providing added services for different situations:

Packing, Storage and Moving

Packing, Storage and Moving

Seller Rent-Backs

Seller Rent-Backs

Relocation (rental and purchase)

Relocation (rental and purchase)

Clearing Liens and Violations

Clearing Liens and Violations

Insurance Auditors

Insurance Auditors

Probate Attorneys

Probate Attorneys

Eviction Attorneys

Eviction Attorneys

Other Legal Matters

Other Legal Matters

Since we’re purchasing a high volume of houses for cash, we can often do these added services as part of the deal.

If you have other needs that weren’t mentioned above, just let us know!

Cash Home Buyer in Maryland You Can Trust

Multiple title companies that can vouch for us.

Multiple title companies that can vouch for us.

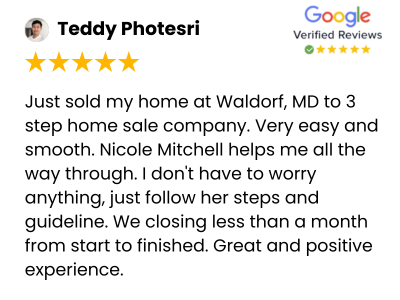

Many raving clients who were gracious enough to give us stellar online reviews.

Many raving clients who were gracious enough to give us stellar online reviews.

Proof of funds from known banks showing we are serious about our offers.

Proof of funds from known banks showing we are serious about our offers.

Physical office location and experienced staff dedicated to get you NOT just an offer but all the way to closing.

Physical office location and experienced staff dedicated to get you NOT just an offer but all the way to closing.

Our client, Carlos Escobar, at closing about to receive his proceeds. Extremely happy after we bought his house of 30+ years in 21 days!

3 Step Home Sale Proudly Serves All Of Maryland

With its rich history and scenic landscapes, offers a diverse tapestry for homeowners and investors alike.

Maryland’s real estate market is as diverse as its landscapes, offering a wealth of opportunities for homeowners looking to sell house quickly to legitimate house buying companies in MD. We have purchased hundreds of houses in the past 15 years. As a trusted cash house buyer in the state, 3 Step Home Sale understands the complexities of the local market. Whether you’re facing foreclosure, inheriting a property, or simply need to sell your house fast, we provide a fair and instant cash offer on your house and a seamless hassle-free experience.

We Buy Houses in Maryland

Looking to sell your house fast for cash in Maryland? We’re here to provide you a fair cash offer and a stress-free process. If you decide to sell your house to us, you can expect a competitive cash bid and a smooth, quick closing. Our goal is to ensure that you feel confident and satisfied with your decision. Sell your MD house for cash today!

We Buy Houses for Cash in the Following Northern Maryland Cities

Aberdeen

Arnold

Baltimore

Bel Air

Brooklyn Park

Catonsville

Cockeysville

Columbia

Crownesville

Dundalk

Elkridge

Elkton

Ellicott City

Essex

Frederick

Glen Burnie

Halethorpe

Hanover

Havre de Grace

Laurel

Linthicum Heights

Middle River

Mount Airy

North East

Owings Mills

Parkville

Pasadena

Perry Hall

Pikesville

Reisterstown

Severn

Severna Park

Towson

Westminster

Is Your House in Central MD? We Serve the Following Central Maryland Cities

Accokeek

Annapolis

Beltsville

Bethesda

Bowie

Capitol Heights

Cheverly

Clinton

College Park

We Also Buy Houses As-Is in Southern Maryland

California

Charlotte Hall

Chesapeake Beach

Hollywood

Hughesville

Huntingtown

Indian Head

La Plata

Leonardtown

Lexington Park

Lusby

Mechanicsville

Prince Frederick

Waldorf

Some Counties We Serve Across MD

Montgomery County MD

Prince George’s County MD

Baltimore County MD

Anne Arundel County MD

Howard County MD

Frederick County MD

Harford County MD

Carroll County MD

Charles County MD

St. Mary’s County MD

Calvert County MD

Calvert County MD

See if we buy homes in your area! We are expert home buyers in Charles County, Montgomery County, Anne Arundel County, and Frederick County as well as most of Maryland. Get a free no obligation cash offer today and know your options!

Getting an offer from us is 100% FREE! No Obligation!

WE LOVE HELPING PEOPLE!

Quick Cash for My House in Maryland

The state’s real estate market offers a unique blend of coastal beauty, suburban convenience, and rural charm, making it an attractive place for homeowners and investors. The state benefits from a strong job market, especially in government, healthcare, and technology sectors. The housing market varies widely, from waterfront properties along the Chesapeake Bay to quiet countryside retreats and bustling suburban communities.

It also boasts excellent schools, diverse dining scenes, and outdoor attractions like Deep Creek Lake, Assateague Island, and the Appalachian Trail, making it a great place to live for families, professionals, and retirees alike. Seasonal market trends often influence home sales, with spring and summer typically being the busiest times for transactions.

For housing assistance and financial programs, visit the Maryland Department of Housing and Community Development. You can find zoning regulations through the Maryland Department of Planning and explore property records via the Maryland State Department of Assessments and Taxation. If you need to sell your home fast, we offer a straightforward, hassle-free cash sale with no agent fees or repairs required.

FAQs About Cash Home Sales

How Can I Sell My Maryland Home Fast for Cash?

Selling your home for cash is quick and simple. Cash buyers purchase homes as-is, meaning you don’t need to make repairs. You can close in as little as 7 days, saving time and money.

I want to sell my house urgently in Maryland. Can you help?

Yes! We specialize in helping MD homeowners sell quickly, no matter the situation. If you’re facing foreclosure, relocating, or just need a fast, as-is sale, we can make you a fair cash offer within 30 minutes.

What Are the Benefits of Selling My House for Cash in MD?

Selling for cash in Maryland offers:

- No repairs needed

- No agent fees

- Close in 7-14 days

- Avoid financing risks and lengthy processes

How Do I Find Trustworthy Home Buyers Looking to Buy My House in Maryland?

To find reputable cash buyers in the state:

- Check online reviews and BBB ratings

- Ask for proof of funds

- Avoid upfront fees and choose local buyers for a smoother transaction

Are There Fees When Selling My House for Cash in Maryland?

Reputable cash buyers typically cover closing costs and charge no fees. Any minor administrative costs should be explained upfront. Expect a slightly lower offer compared to listing but save on repairs and agent commissions.

Can You Buy My House As-Is for Cash in Maryland?

Yes, you can sell your home as-is for cash. Cash buyers purchase properties in any condition, without the need for repairs or renovations, speeding up the process.

3 Step Home Is Your Trusted Cash Homebuyer in Maryland

If you’re in search of a real estate company who buys houses for cash in Maryland, we are here to provide you with a reasonable offer. Sell Your House Fast with 3 Step Home Sale! As seasoned real estate professionals and adept problem solvers, our team stand ready to assist you with any real estate circumstance you may be in. Whether you’re facing foreclosure, needing to downsize, or just want to sell fast and move forward, we can quickly and smoothly buy your house.

Sell My House As Is For Cash in Maryland Quickly

— The Easiest Way

Committed to Helping You Every Step of the Way. Give us a call (855) 918-4010 or fill in the form below to experience the difference! We offer quick cash for homes in most areas of Maryland!